The Definitive Authority on

Commercial Real Estate AI

A partnership of senior CRE practitioners, capital markets veterans, and AI technologists. Institutional-quality market intelligence, 400+ AI tools evaluated through the 9AI Framework, and direct advisory services for CRE investments and acquisitions across the full value chain.

Three Pillars of CRE Intelligence

Institutional analysis, the most comprehensive AI tools database in commercial real estate, and direct capital markets advisory.

Market Intelligence

Institutional-grade sector analysis anchored in primary data from CBRE, JLL, Cushman & Wakefield, and CoStar. Every article advances a thesis sophisticated investors cannot find in a brokerage report.

Read the latest analysis →AI Tools Database

The most comprehensive evaluation of AI tools serving commercial real estate. 400+ tools reviewed through the 9AI Framework across acquisitions, underwriting, property management, capital raising, and 15 additional disciplines.

Browse all 20 sectors →Capital Markets Advisory

Direct advisory for sponsors, operators, and investors. Debt placement across hundreds of active lender relationships, equity capital raising, acquisition sourcing, and AI agent deployment for CRE workflows.

View advisory services →Institutional-Quality Analysis

Deep sector analysis anchored in primary data, institutional sources, and forward-looking theses that go beyond consensus.

- Tobler Valuation Review: MAI-Certified CRE Appraisals with AI-Enhanced Workflows

Tobler Valuation combines MAI-certified CRE appraisal expertise with AI-enhanced workflows across Gulf Coast markets. 9AI Score: 62/100.

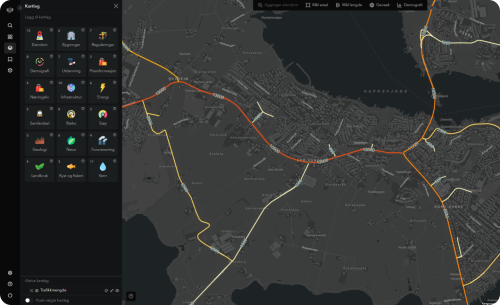

Tobler Valuation combines MAI-certified CRE appraisal expertise with AI-enhanced workflows across Gulf Coast markets. 9AI Score: 62/100. - Placepoint Review: Norwegian Spatial Intelligence for Real Estate Development

Placepoint delivers AI-powered spatial analysis, 3D mapping, and property intelligence for Norwegian real estate developers and investors. 9AI Score: 62/100.

Placepoint delivers AI-powered spatial analysis, 3D mapping, and property intelligence for Norwegian real estate developers and investors. 9AI Score: 62/100. - PriceHubble Review: AI-Driven Property Valuations Across 11 European Markets

PriceHubble delivers AI-powered residential property valuations and market intelligence across 11 countries. Serving 800+ companies including major European banks. 9AI Score: 73/100.

PriceHubble delivers AI-powered residential property valuations and market intelligence across 11 countries. Serving 800+ companies including major European banks. 9AI Score: 73/100.

Built for the Entire CRE Ecosystem

Over one million licensed commercial real estate professionals operate in the United States. BestCRE serves the full spectrum.

Sponsors & Syndicators

Capital stack optimization, equity raising, investor relations systems, and deal-level advisory across all commercial asset classes.

Brokers & Agents

AI tools for prospecting, transaction management, market analysis, and sales scaling across investment sales, leasing, and mortgage brokerage.

Investors & Family Offices

Independent market intelligence, CRE investments analysis, and direct access to advisory services for portfolio strategy and capital deployment.

Technology Companies

Independent AI tool reviews through the 9AI Framework and placement in the definitive CRE AI tools database covering 20 sectors.

The 20 CRE Sectors

AI tools and market intelligence across 20 commercial real estate disciplines. From acquisitions and underwriting to sustainability, insurance, and investor relations. Every sector has practitioners on our team who operate in it daily.

Explore All 20 Sectors →BestCRE is an independent editorial and advisory platform. We do not accept advertising or referral fees that would compromise the independence of our analysis. Learn more about BestCRE or contact our team.